Well! Well! The Forex time frame you should trade all depends on you. Good enough Forex trading is available 24-hours;day and night for five days in a week.

You can choose any time frame that makes you comfortable to trade and convenient for your personalty schedule.

No one is going to boss you around that you should be available for a trade with in this time period. It’s just you bossing yourself around.

If you feel that the 5 minute is very short for you to trade or you cannot sit in front of the computer all the time, don’t frustrate yourself simply adjust to a higher time frame.

You can choose to trade on H1, H4, daily or weekly or monthly.

Choose to trade on a time frame that fits your life style

What do I mean? Whatever choice you make, should match your personality.

You cannot be a scalper and you choose a H4 chart or daily neither can you take a 1 minute chart when you want to do a long term trade.

It doesn’t make sense at all.

Like i said, the forex time frame you should trade on must fit your life style

What forex time frame should you trade?

Here are the main forex trading time frames

- 1 minute time frame(M1)

- 5 minute time frame(M5)

- 15 minute time frame(M15)

- 30 minute(M30)

- 1Hr time frame(H1)

- 4Hr time frame(H4)

- Daily time frame(D1)

- Week time frame(W1)

- 1 Month time frame(MN)

The forex time frames are categorized into different groups. That is;

- Long Term – This time frame for a position traders; covers a period lasting from a few weeks to months or sometimes a year

- Medium Term – Medium time frame is for swing traders. The trader covers a period lasting from more than one day to a few weeks.

- Short Term – This time frame for a day trader. It covers a period lasting from seconds to an entire day session.

Therefore depending on the kind of a trader you want to be, you can tell the kind of time frame that suits your trading strategy.

Choose a time frame for your trading strategy depending on the type of a trader you want to be.

The time frame you choose for your strategy should match your personality and you should trade only that.

This way, you will be able to maintain your trading discipline and profit consistently on your trades.

What is your personalty like

You want trades to close fast or you don’t have the patience to wait for long hours.

The small time frame suits you well. You will trade on charts of 1 – minutes to 15 – minute chart.

This is because each movement is so fast, you don’t take long analyzing the charts.

In addition it has many set ups.

However this comes along with its disadvantages.

Surely You are likely to experience many fake out signals and you have to stay in front of computer during the entire trade.

You are patient and can wait for longer hours but cannot sleep with a running on your computer.

It’s very easy, be a daily/day trader.

As a daily trader, you start your day looking at the opportunities for the day, and hold trades only during the day.

At the end of the day, you close all the open trades whether in profit or loss.

Suitable time frame to trade is M30, H1 and at most H4. H1 is the most suitable.

It is longer but not too long and you cannot fail to find 3 – 5 trade signals

. This gives you much time to analyse the market and you don’t have to stay in front of your computer all the time.

You like to take things slowly, take your time on each trade. Or have a busy schedule of work.

Here you trade only on higher time frame. This means you hold trades for days, weeks or even months.

In a high time frame, the price movements are slow.

This gives you time to look at your chart and analyse the market correctly before entering your trade.

A high time frame trader looks at his charts once in a while and see what is happening in the market.

Mostly they do analysis during the weekends or when the week is beginning and ending.

With larger time frames, you don’t have to sit in front of the computer all the time.

However, you be required to trade with a larger trading account to cater for large price adjustments that happen over the week.

Trades take long to mature so you must have the patience to wait.

All in all, choosing a time frame to trade depends on your personality.

If you are still confused about what forex time frame you should trade on;

Here is the way to go.

Open a demo account and try trading on all time frames.

Make a follow up every time you try a different time frame.

This is the best way to know your personalty and the time frame that suits you.

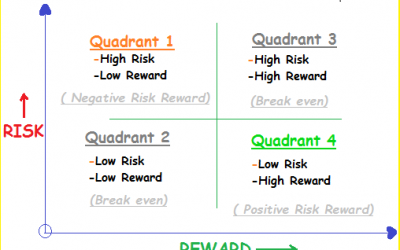

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.