There are 5 main different types of forex traders in the market.

There are 5 main different types of forex traders in the market.

The Only difference is the timeframe of positions they hold except for mechanical traders who use automated systems to generate signals on any timeframe.

If you are definitely not a scalper, then do you know the kind of a trader you are?

Let’s see! To know the kind of a trader you are, you have to look at your trading style or personality.

Your personality determines the kind of a trader you want are.

For example, how long do you stay in a trade from the time of entry to the time of exit?

Before we get to discuss the different types of Forex traders, let’s look at some of factors you should consider to determine your trading style.

Things you should consider when determining your Trading Style

- How long do you hold a trade.

- Your level of patience, for a trade to close

- The Size of your trading account

- Type of time frame you are comfortable to trade on

The different types of forex traders vary from scalpers, day traders, swing traders, position traders and mechanical traders.

What types of forex trader are you?

A Scalper

Scalpers hold on to trades for a few seconds to a few minutes.

They sit in front of the computer all day. Their aim is to grab very small gains at the busiest times of the day.

Scalpers trade in very fast price moving market situations, when the market is most liquid.

A Day Trader

Day traders hold trades for minutes to hours. Their trading time frames range from 15 minutes to mostly 4- hour time frame.

Day traders trade on a routine.

They start trading at the beginning of the day and closes all positions before the end of the trading day, so as not to hold any overnight.

Day traders close all positions at the end of each trading day whether in profit or loss.

a Swing Trader

Swing traders hold onto trades for longer than a single day. If you are a kind that likes to hold on to trades for several days to several weeks, then this is for you.

The swing traders don’t have the patience to sit in front of the computer all day looking out for setups.

Therefore, they do most of the market analysis mostly at night and let their trades run during the day.

a Position Trader

Position traders hold trades for longer periods of time.

Trades can last for several weeks, months, or even years.

If you want to talk about patience, these are your guys.

Again, If you plan to become a position trader, first you need to cheek your trading account size.

You need a bigger account to be able to cater for price swing adjustments and enough for your stop loss. Position traders use large stops for their trades since trades run for long.

Also, their market analysis is mostly based on fundamental factors. Mainly trade on weekly and monthly time frames

a Mechanical Trader

Mechanical traders use automated systems to generate signals to trade.

They rely on computer programs to place trades for them at the best possible prices.

Mechanical Traders choose a system to follow and program it in a way that it can pick setups, set stops and targets for trades as well as maintain positions without them around to control the trades.

However,this type of trading suits people who are comfortable with using technology.

Final Remarks

Finding the type of a trader you are is a very important thing.

The person you’re, your personal habits, determine how much time you can dedicate for your trading.

As you begin your career in trading, this is a very important factor to consider if you want to gain in trading Forex.

Choose something that suits you. What you should know, is that you cannot be all. You are either a scalper or a position trader. But not both.

In fact, If you start as a scalper and you realize, price is a bit fast for you, or it’s stressing, adjust to a day trader or swing trader. Until you find what actually suits you well.

We shall look at each in details in the next lesson. Hope this helps you to find a trading style that suits you perfectly.

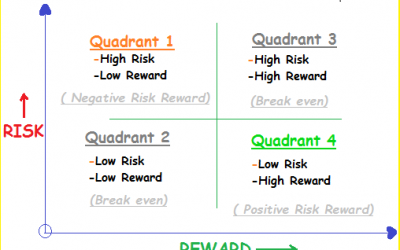

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.