Day traders in Forex open positions at start of day & close their trades at end of day.

They don’t hold trades overnight. Good Time Frames for day trading are 15 min, 30 min and 1 Hour.

Day traders slightly differ from scalping traders by time difference.

If you still want to do a short-term trade and scalping is not a thing for you, you can try day trading.

Day Traders in Forex base on a daily time frame, H4 and H1 time frame to analyze the forex market. Mostly they trade the 15min, 30 Min chart, H1 chart and H4 chart time frames.

Trading positions are open at the start of the day monitored and closed at the end of the day whether with a profit or a loss.

What you should consider to become day traders in forex

You should consider having a daily trading plan.

A trading plan should have;

- The setup you trade,

- What makes it worth trading or not,

- Your entry and exit levels

- The risk reward to use and how much you should risk per trade.

- It should also have rules to trade and how to modify your running trade.

Keep yourself updated with the daily or latest economic news so that you are able to prepare for swift news movements during your trading session.

You should be able to have sometime on your trading platform to monitor your running trades and make adjustments if necessary.

That’s not tight, is it? Let’s see the different types of day traders in forex.

Different types of day trading.

Breakout trading.

Here you only trade when a break out happens on strong market levels.

These include, support or resistance levels, Trend lines, Channels, Triangles, and Fibonacci retracement levels.

They are market psychological level because they are watched by most of the traders.

With break out trading, you take trade after a confirmation of the price break at any of the levels of support and resistance.

Breakouts normally occur when the currency price has been in a consolidation for a long time or on start of a new trend.

Take a look at the Chart below

When you trade breakouts, your stops should be placed a few pips below or above the support and resistance level depending on the current market volatility.

Reversal trading.

Reversal traders can trade at the end of the trend (reversal patterns) or within the trend between support and resistance.

After a long up trend,

The market price may start to form tops or consolidates. This shift in momentum gives a signal that a trend is actually ending. So you should prepare for a reversal to the downside.

We also always see price reverse as it approaches certain levels in the market making up and down pivots.

For example, the levels of support and resistance.

As a day trader you can choose to trade only when price gives reversal signals.

In this case, take trade when price bounces on support and resistance levels. You buy on a support level and sell at resistance.

Alternatively, take trade when price forms reversal patterns like heads and shoulders, double and triple tops and bottoms.

Sell when reversal patterns in an uptrend confirm and buy when reversal patterns in a downtrend confirm.

Take a look at the Chart below

Head and Shoulders Day Reversal

Conversely, after a long downtrend, market price may start to bottom or consolidate. This is an indication that a downtrend is coming to an end. Reversal to the upside.

Trend and Range trading.

In ranging markets, price moves in the side ways direction. You buy on a support level and sell at resistance.

Take a look at the chart below

With trending markets, prices move strongly in one general direction for a specific period of time.

Here, day traders base on the direction of a long time frame to determine the trend direction and trade on a smaller time frame.

For instance if your trading setup appears on a 30 min chart, you can use an H4 time frame or daily to determine trend direction.

Once you determine the overall trend, you can use the smaller time frame to look for entries in the same direction. This is done using multi time frame analysis.

Trading with multi time frame analysis

Multi time frame analysis is analyzing charts starting with a bigger time frame going down to a smaller time frame.

The bigger time frame helps you define important levels of support and resistance and the current price swing of the main trend.

The lower time frame will help you to know the current movement and how it is reacting to strong support and resistance zone and give entry signal confirmation.

You only take trade when the three time frames come to an agreement.

Indicators can also be used to help you confirm the direction of the trend.

News Trading

News day traders in forex trade only after news release. They base their analysis on fundamental factors affecting the major globe economies.

News traders spend less time on charts and technical analysis and more on economical fundamental data.

They wait for information to be released because they believe news moves the market.

Mostly the focus on economic data from the U.S. such as unemployment, interest rates or inflation or simply breaking news.

Trading news is very challenging but when mastered, it is very profitable.

Traders may know news that move the market, however it very challenging to predict which direction the market will take.

Also, during news release, spreads tend to enlarge and slippages are likely to occur with some pairs. Trading news is very profitable but when wrong, it may draw down all your money in just a second

It is important to exercise good risk management once you decide to trade news and choose pairs that are more liquid.

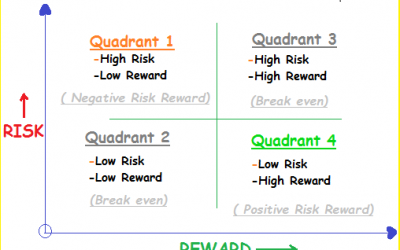

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.