Looking at day trading multiple time frames before opening a position helps you to choose a better setup for your trade.

Choosing a group of time frames depends on the kind of personality as a trader.

Although most traders like to analyse higher time frame and lower time frame comparing it with the time frame they are interested in.

For instance,

If you are trading a 15min chart, you can consider a 5min , a 30min and probably an h1 chart.

Or if you are interested in an H4 chart you can have a look at a D1 chart and H1 chart.

Day trading multi time frame analysis

Smaller time frame, medium time frame and large time frame

| Small time frame | Medium time frame | Large time frame |

| 1 minute | 5 minute | 15 minute |

| 5 minute | 15 minute | 30 minute |

| 15 minute | 30 minute | 1 hour/60 minute |

| 30 minute | 1 hour | 4 hour |

| 1 hour | 4 hour | Daily |

| 4 hour | Daily | weekly |

The smaller time frame is below the time frame you are trading and large time frame is above the time frame you are trading.

This means your trading set up is on the medium time frame.

Looking at a larger time frame will help you to keep trading with a trend therefore keeps you in a trade for long.

You will be able to identify the key levels of support and resistance near your position that may not be identified on the time frame you are trading.

As your chosen time frame gives a signal to trade, the lower time frame will help you to confirm the entry and exit levels.

Once you have determined the direction of the trend and you already know your entry and exit levels, then you are good to go.

Make sure the kind of time frames you choose to trade matches your personality and use only that.

Now that you know the benefits of day trading multiple time frames, its high time we taught you how you can do that so that you don’t miss out any profitable opportunities.

Let’s see how!!

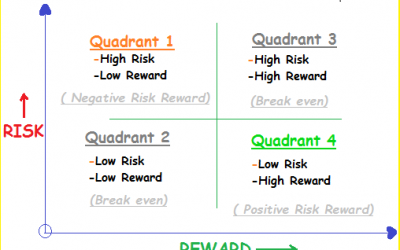

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.