For the next few days, yes, US CPI Data to be released today at 12:30 GMT will determine Gold next directional move.

The price of gold might rise to its all-time high of $2,195 in the event of a downside surprise in the US CPI data. To reach the critical $2,250 level, however, a sustained break over the $2,200 barrier is required.

However US inflation data suggests that the gold price will likely drop, bringing it closer to the $2,154 low of March 8.

On the larger technical basis, smaller timeframes show overbought conditions which also indicate a pending downfall.

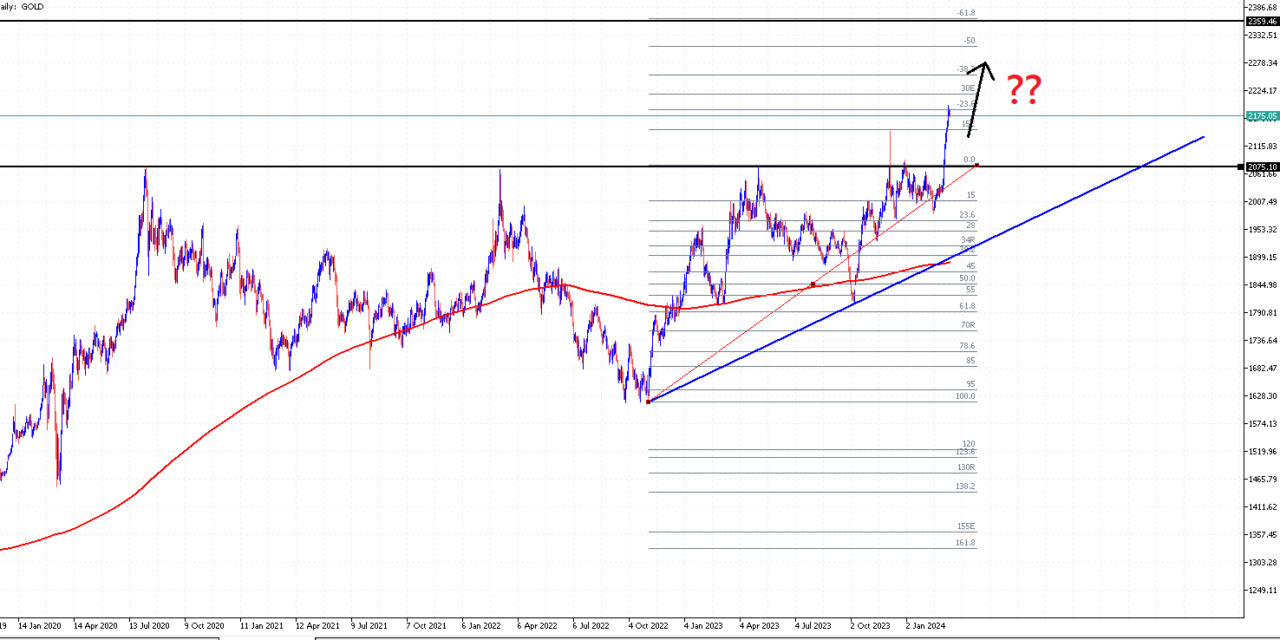

However when we focus on the daily chart below,

The 2075 level, a huge resistance zone now turned into support has been broken with strong momentum. This resistance zone was retested more than 3 times before the strong break out.

Due to news and all these trend exhaustion signs on lower timeframes, pullbacks are expected. But with this kind of momentum, the general Gold next directional move is still bullish/upside.

Going forward, it may not be easy to set precise bullish targets for Gold because it’s trading in uncharted territory. On the upside, the $2,200 round level could act as a psychological resistance.

Key Points to pick:

- Keep the shorts / sell trades on the small time frames.

- Fundamentals will have very huge impact on Gold next directional move