Hello fam, As the year comes to a close, I wish to share forex wave rules that have kept me in this business.

I started off trading currencies hoping it would be an easy task but i have learnt over time that for our lives to be easy we must do what is hard.

Trading is already paying and i thank God that I learnt about trading early in my life. I am already looking forward to the next year and as others jam entertainment joints to splash their cash. I will be indoors sharpening my skills in preparation for the next trading year.

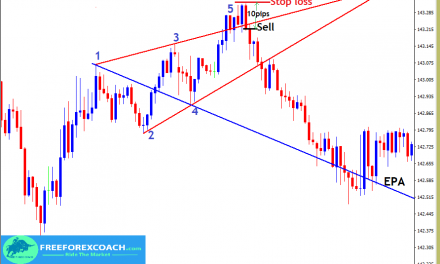

As wave traders, before we enter any trade we look at these forex wave rules for entry and exit. We thereafter manage our trades and move with structure.

I have previously shared with you some of the patterns that we look at (we combine Elliot waves and classic patterns).

Our Forex Wave Rules

The rules are as follows and they will be repeated several times during analysing a specific price chart.

1. Structure drawing

This is done on past price chart data. I have previously also done an article of how to identify and draw structure lines for us to make a decision.

Remember we don’t just click on buy/sell on the trend lines. The trend lines are just points where we watch the markets for us to make a decision on what we should be doing at those specific points.

For this specific case i will use the GBPCHF chart to make my illustrations.

2. Pattern identification :

After we have drawn our structure we then dig deeper and identify and name the patterns in the structure.

There are two kinds of patterns that we look at namely trend continuation patterns and trend reversal patterns. The trend continuation patterns signal to us that the trend is expected to continue. On contrary the reversal patterns tell us that we may be coming close to the end of a trend.

This pattern’s article can be found on the education section of the website. (please take your time and look at it)

3. Future indication :

This entails reading the indicators to have a feel on what they are saying.

There are various arguments on which indicators are best and which ones work best. To me indicators are mostly lagging but they can tell us what the market is doing. we should therefore look at price action as we also look at indicators too.

In this case I will prefer using the MACD indicator. you can however use RSI, Bollinger bands or even stochastics and still end up with the same result.

4. Future wave :

After we have looked and observed the above rules we now have to draw our future wave that helps us set targets and know what we are risking.

Remember trading is all about risk management. We should never trade without using stop losses.

5. Future Reversal Point

This is the point where we expect the future wave to reverse again or change. This is the point at which we are also expected to bank our profits.

With the above forex wave rules, I wish you a merry Christmas and a happy 2019.

Follow us on facebook (Kaliq asset management ltd) for more trade set-ups. Thank you for always taking time to read our posts.