Once you are in the forex market, all you need is a few variables to show up on your trading and you take a trade. These variables define your trading system.

Before we get any further, first of all you need to decide which broker to trade with. You must also own a trading account of your own. You can use a demo account or a real account.

Now that you have an account to trade on, then what kind of variables do you need to trade?

Trading variables are the characteristics/traits your trading set up must show to give you confirmation to take a trade. These variables define your trading edge and certainly match your trading rules.

For example, if I am trading price reversals on support and resistance, I may look at candlestick patterns, current volatility in the market and my risk to reward ratio.

Or for any given entries, in the market, one may choose to look at price momentum, market overbought and oversold conditions, candlestick patterns, volatility, market bias and so on… the list is long.

Your trading variables necessarily tell you when to take position, adjust position or exit position.

In other words, it defines your trading edge.

What is a trading edge? And why you need it to trade forex?

A trading edge is a trading method that a trader believes in to give him/her an advantage over the market and other traders.

It can be a pattern, an indicator, or a combination of specific variables. Traders use this to put them at an advantage in the market over other traders.

Anything you can use to keep you making consistent profits and small losses. It can be a strategy, a skill or a belief.

Let’s look at some of the trading edge

For example, you may choose to trade every time price reverses on support or resistance. Or trade following the main trend.

This simply means every time you take a trade; you stand higher chances of making more profit. However, this does not mean that you won’t make a loss at all.

Despite having a trading edge, it is also possible to make losses as it is for profits. This is because there is always a random distribution between winning and losing trades in the market.

“If you believe that an edge is simply a higher probability of one happening over the other, and there is a random distribution of wins and losses for any given set of variables that define an edge, then don’t gather other evidence. And if the market is offering you a legitimate edge, determine risk and the trade.” Mark Douglas

Why you need a trading edge to trade forex?

To have a trading edge is to trade consistently in profits. Your trading edge allows you to have more winning trades than losing trades in your trading cycle.

For instance, if you take ten trades a day, 7 win and 3 lose, you stand a higher advantage of achieving accumulated profits. It means at the end of your trading day, if you get your wins less loses, you remain with a profit.

Once you have discovered your trading edge, your confidence too rises. Your mind successfully aligns with the market. You can easily receive and interpret the information available in the market at that moment in the market.

This way you can always identify new and good opportunities available in the market. In the same way, your trading edge protects you from holding on to losing trades since you can easily tell when a trade fail.

Besides having a trading edge, another one thing you need to trade forex is to know how to determine the market bias.

What is a market bias on how to determine the market bias?

A market bias is the majority opinion of most traders in the market. How most traders are likely to behave/react at the moment in the market. Before taking any trades, it is very important to first know which path the market is likely to take and how it is behaving.

Before taking any trades, you need to know whether the market is trending up, down or still in congestion. This will help you to make quick and good decisions when trading. For example, what market to trade, when to enter a trade and where to cut losses and exit.

In this case, we shall need some of the technical analysis tools to help us determine the market bias.

They “includes; the moving average, price action, support and resistance.

Determining market bias with a Moving Average.

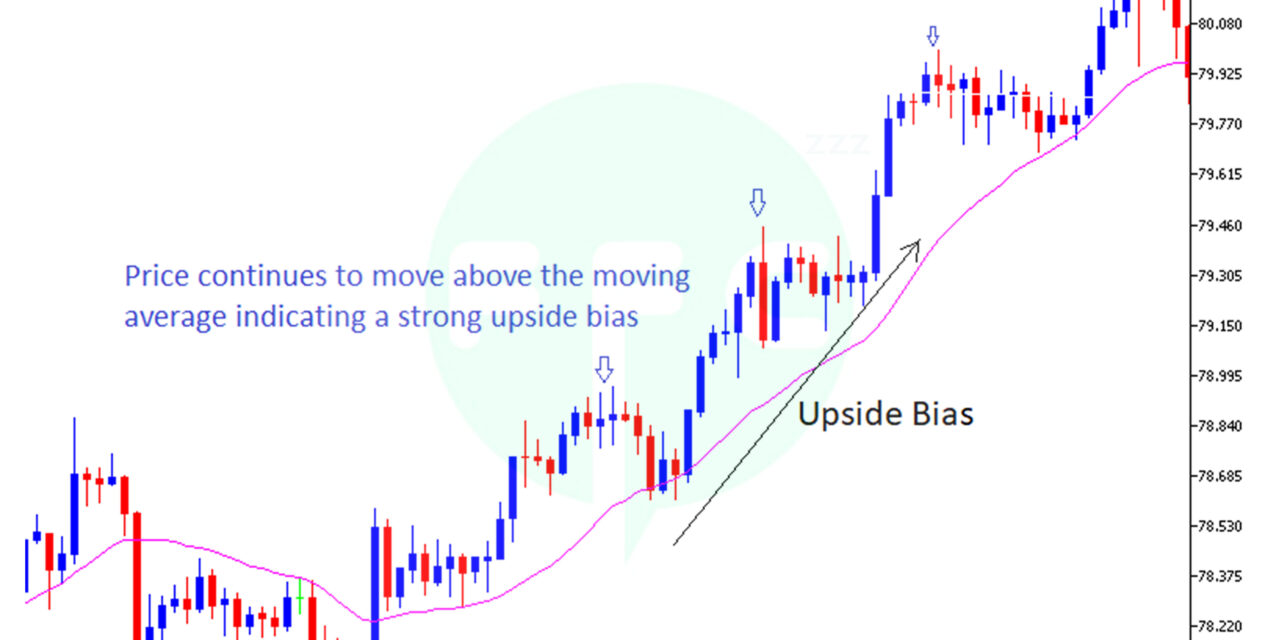

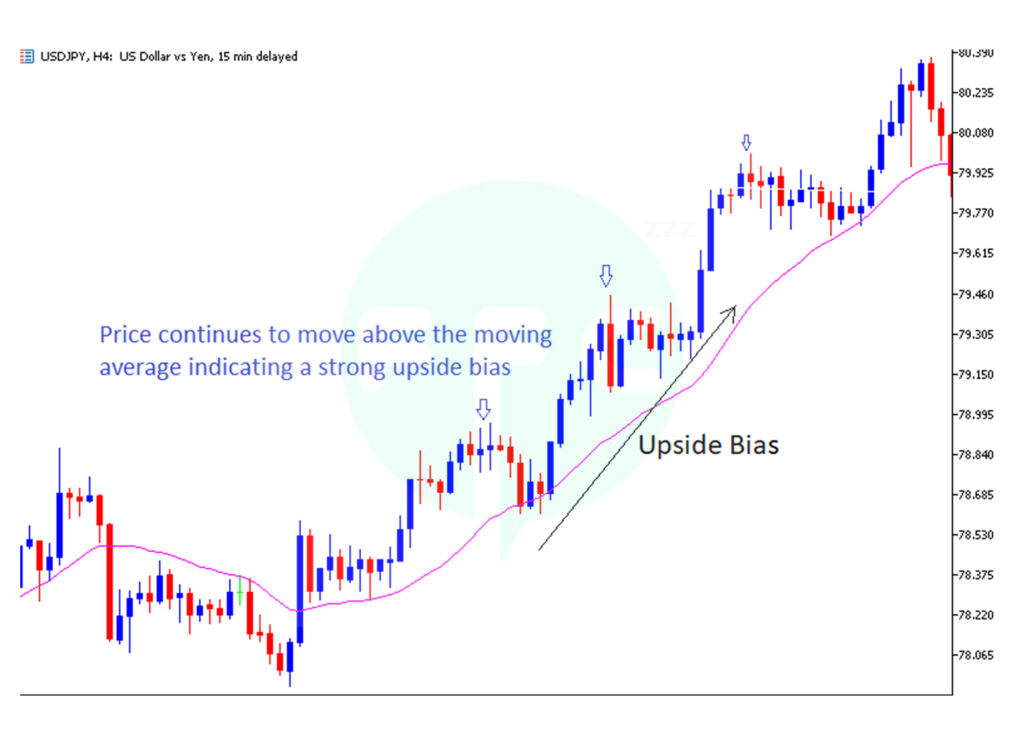

A moving average is a trend following indicator therefore can be relied on to determine the direction of a trend.

When price is moving above the moving average, price is moving in an uptrend. Therefore, the bias is up. Here you should look for buy opportunities.

The above chart shows that, every time price touches the moving average, it reverses back to the upside. This clearly indicates that the upside is stronger than the downside. There fore we expect trend to continue moving upside for a while. you can take advantage of the trend by taking positions every time price reverses on moving average.

If price is moving below the moving average on the other hand, the market bias is down. You should look for sell opportunities.

Here all you need to trade is watch how price behaves along the moving average and base on that to determine the market bias.

When your moving Average crossover prices, it’s an indication that the trend is about to change direction.

Determining market bias with Support and resistance.

On your support and resistances levels, identify possible price reversal or breakout signals. If chances are that price is likely to reverse on resistance than break through, look for the downside bias hence sell opportunities. The reverse is true.

On the other hand, if price is more likely to reverse on support and break through, then the bias is to the upside. Look for buy opportunities.

Price action

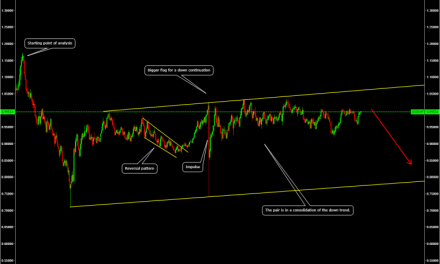

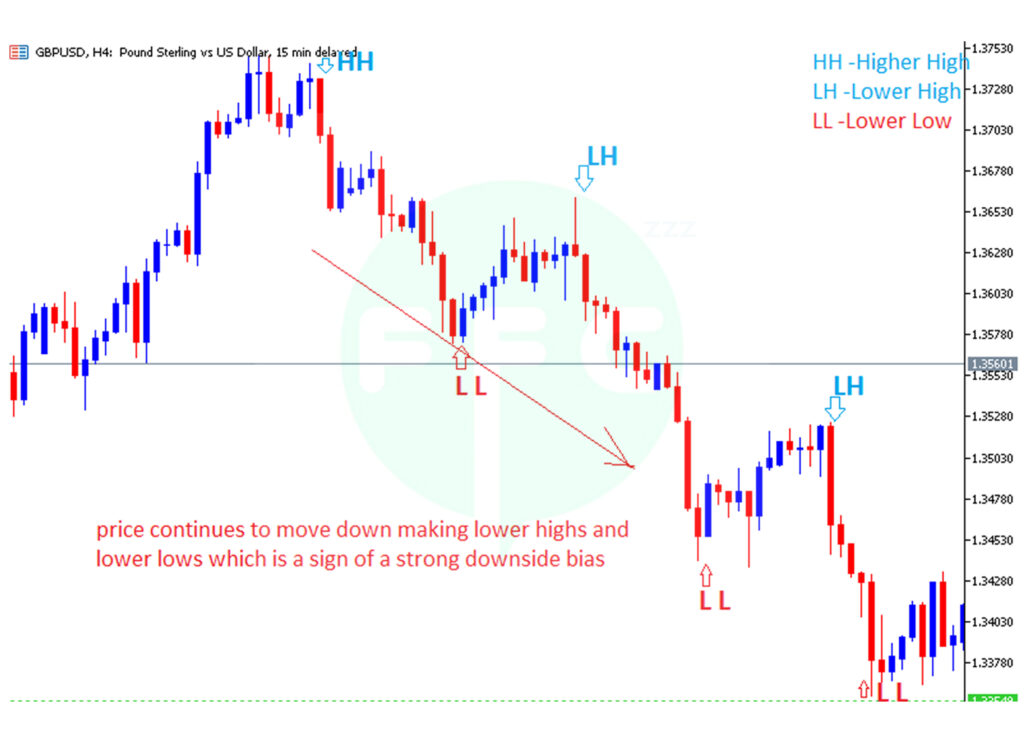

Last but not least, to determine the market bias using the price action, you should focus on price lows and highs in a trend.

When price is making higher highs and higher lows, the bias is shifting to the upside. Look for buy opportunities in the market.

From the above chart, you can clearly see that price continued to trend upwards every time it made a higher low. In this case, you would take a trade after price finishes retracement on the next support level and buy on reversal.

However, if the trend is making lower lows with lower highs, the bias is to the downside. Look for selling opportunities.

if you are to take advantage of the downside bias, looking at the chart above, sell on reversal to the next resistance for a retracement.

All in all, what you need to trade forex, is consistency in your trading behaviour. Having the right market bias and the trading edge does not guarantee that you will not make a lose. However, if you keep following your trading rules consistently, your losses will be insignificant with the right edge and market bias.