When trading Forex, you close a trade or a trading position to take a profit or a loss.

More often times you get in a trade and get caught up in between to decide whether to close out a trade or let it keep running.

At this point you struggle with confussion because you are not sure if the decision you are about to make is the right one.

It is the psychology playing on you. At the moment, you are either scared to lose, to accept the risk or greedy.

How emotions play on us is quite interesting. You will find yourself in a losing trade but can’t let go. Hence making more loss. Or else, you will settle for small profits because you are scared to make another loss.

In the same way, when you get greedy, you will find yourself staying long in a trade than normal because you want to make an extra profit. In the process, the trade goes against you and you end up losing back the money to the market.

All this happens because you don’t know when to close trade.

When to close trade when a market is moving to your predicted direction.

A market moving as predicted simply means you are making profits. To close trade when a market is moving right is very challenging to most traders. It’s like telling a child to just stop eating a candy he/she is just holding. Imagine how hard that is.

As a rule of thumb, you should always know that the market cannot move in one direction forever. At any point, it can always reverse.

Secondary, you are not the only person trading. Therefore, you need to factor in the possible behaviours of the other traders in the market. For instance, they can exit, take more trade, or hold and wait to trade. Every other traders decision/behaviour affects you in one way or the other

Although it every trader’s goal to exhaust every chance available to accumulate profits, you must know when to close trade to exit.

Therefore, before you take any trades, it is very important to pre-determine your target/take profit level (risk to reward ratio).

When you know how much you expect to make from the market movement, you will not hustle with where to close.

Set the target and the trade will automatically close when it hits the level.

In situations, where you believe that the market may continue past your target level, especially when a new trend has just started;

You may keep your trade open but use a trailing stop and close trade when there is a clear signal to exit.

A trailing stop is an order that locks in profits as price moves to your favour. Like the stop loss, if the market reverses back to that level, the trade will automatically close.

Partially close a trade (scaling out). For example, if you opened a trade with a size of 1, you can close it with 0.5 and leave the trade running with 0.5. This depends on how confident you’re about the market.

Or you may close trade and take a new position on retest/retracement. Then close trade when you get a clear signal to exit.

Some of the indicators/signals you should consider to close a trading position.

An obvious trend reversal.

When price has hit its overbought levels in an uptrend or oversold levels for a downtrend, chances are a high for it to reverse. You should close trade and wait for new opportunities.

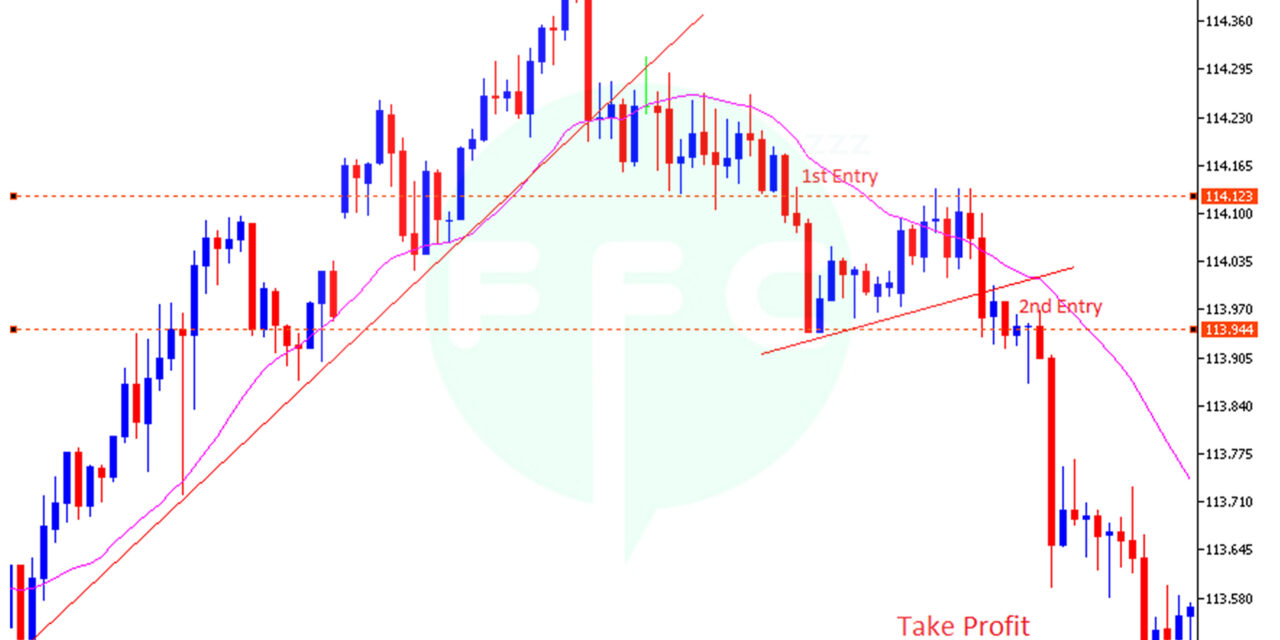

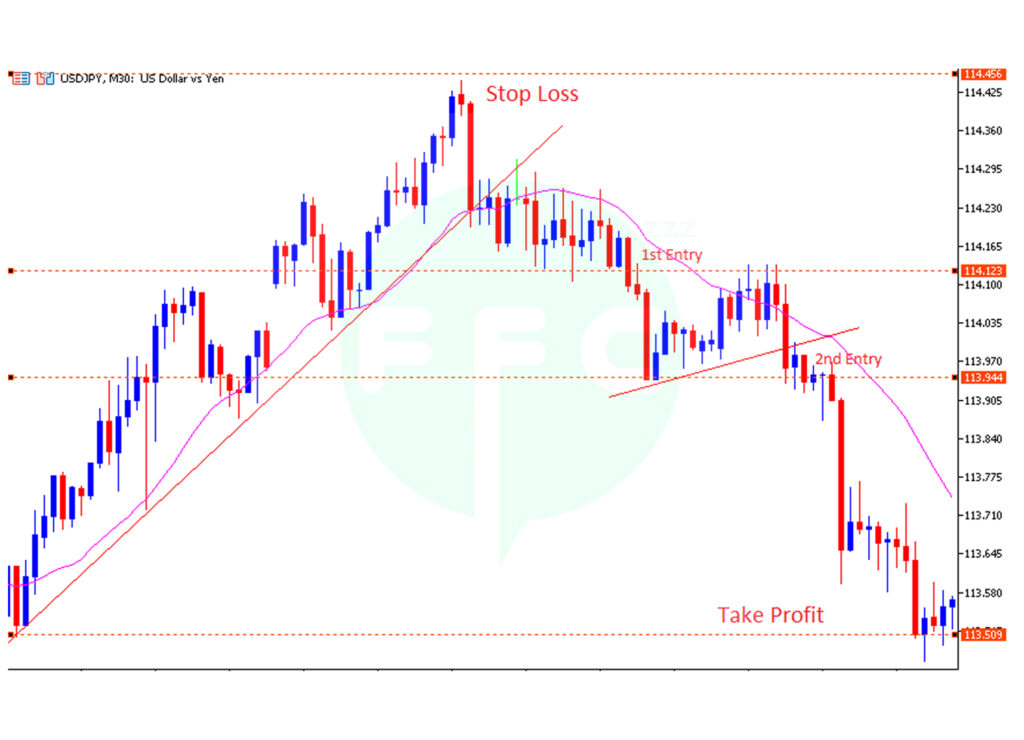

If you notice a trend is losing strength (change in momentum). Some of the signs, market speed reduces. The market starts to make small candlesticks. You are also likely to see double tops or bottoms patterns

If price starts to make lower highs and lower lows instead of higher highs and higher lows for an uptrend. Or higher low and higher high instead of lower low and lower high for a downtrend.

Price action signals

Long pin bar and reversal candlestick pattern.

To mention but a few, a large bearish pin bar or bearish engulfing pattern, a doji, a shooting star in a rising trend maybe a strong signal for a possible trend reversal. Lookout for reversal candlestick patterns.

When you see change in price speed/ market behaviour and appearance of the above-mentioned candlestick patterns, you should probably close your trade.

Market Support and resistance

In an uptrend, when price approaches resistance, chances are high that it will reverse than break through. The same happens on support for a downtrend.

Support and resistance on a higher timeframe are more significant compared to that on lower time frame.

For instance, price is likely to break a 30-minute chart support or resistance and reverse on a daily chart support or resistance.

For a daily trader, if you have already made a significant profit on your trade, and you notice price getting in a daily resistance or support zone, don’t risk it. Just close your trade and wait for new opportunities.

Also, if you don’t feel comfortable watching your trade on a support or resistance zone on any timeframe, just close it. You can always take a new position after the breakout confirmation.

The above chart clearly show price reversal on the support level. Price moved back above the entry level after reversal on support.

If you had closed trade at this level, then you would be looking at the new opportunities. Either to sell again if price doesn’t move above the previous stop loss level or buy after breaking above the previous stop loss level.

However, if you had kept the trade, you would still wait till it breaks your stop loss level and it closes or it moves back to your direction. The fact that price hadn’t reached your stop loss, your trade is still valid.

When to close trade when a trade is moving against your prediction?

Since no one ever wants to keep a loss, it becomes a problem for most traders make decisions to close losing trades early enough.

You may close your trade with a stop loss or before when you choose to cut losses or after all your margin is done and you are stopped out.

The number one reason why most traders especially the newbie traders don’t make profits is because they stay long in losing trades. In end, either blow their accounts or close in large losses.

Closing a losing trade is psychological. It does not matter how good you are at analysis, or how best your system is. If you can’t fully accept a loss when trading, you will never make profit.

Making a loss when trading is normal but large losses are not. This is as a result of emotional trading influenced by greed or fear.

Knowing when to close trade on a losing side is the best way to cut losses and protect your money.

Never hang on a losing trade when you can close it and take on a new opportunity.

Use a stop loss.

A stop loss is a predetermined level below your entry for a buy position or above entry for a sell that will automatically close your trade when price goes against your prediction. The main aim is to prevent further loss.

When you use a stop loss, you know how much you will lose in case a trade fails.

Cutting Losses

You can also choose to close your trade before it hits your stop loss level. Every trading strategy has indicators or signals that you look at before you take trade. In the same way, you have signals that confirm a failed trade.

When these signals appear on your trade setup, it becomes obvious for you that the trade will not work. In this case, you don’t have to wait for the price to reach your stop loss level. Just close the trade and cut on the loss.

Break even

This is very common for most traders who never use a stop loss. When the loss becomes unbeable, the only best hope is to breakeven. This a serious vice every trader should avoid.

Breakeven is equal to your entry price level. It is the point at which your trade neither makes profit or loss.

You can move your stop loss to the break even point once price has moved further from your entry to your favour.

When a failed trade has retraced back to your entry in case you had no stop loss and manually close trade.

Key points

- Close a trade after you have hit your target profit and exit

- Close a trade when price reaches your stop loss level

- When a trade has shown all signals that it failed

- When it is necessary to give margin to a more profitable trade, you can close so trades that are less profitable or have a large loss.

- Last but not least close and exit trade when you see an obvious reversal in a trend you are trading.

………..