The pip value is calculated in terms of the quote currency or the second currency in the pair.

You can also calculate pip value using the exchange rate.

This happens in case the account denomination is different from the base currency.

Factors considered to calculate pip value in monetary terms

To calculate the pip monetary value in your account denomination, you need to first know the following;

- The quote or the second currency in the pair

- value of the a pip using the quote currency.

- The size of the lot/contract in the base currency e.g for a standard account, 1 pip (0.0001) = 100000 units,10000 units for a mini and 1000 units; for a micro.

- Current price of currency pair or exchange rate.

- Minimum pip value in decimal places.

Pro tip: It is the quote currency that determines the pip monetary value.

Formula;

1 Pip = (pip value in decimal places × trade size in units)/exchange rate.

The pip monetary value for the quote currency is equivalent to $10, $1 or $0.1.

This depends on the size you are using to trade, for currencies whose quote is to 4 decimal places. Though this does not apply to Yen quote currencies.

Yen pairs will take up values of $1000, $100,$10.

When your account capital is in USD

If you are trading a pair having a USD as a quote currency, the pip monetary value is $10,$1,$0.1 according to the size you are using.

Some of these pairs may include, EUR/USD, GBP/USD,NZD/USD, AUD/USD.

In this case, if the second currency of a pair is the same as the currency on your trading account, the pip value is equal to $10, $1, $0.1 for a standard pip value. This varies according to the size you use to trade.

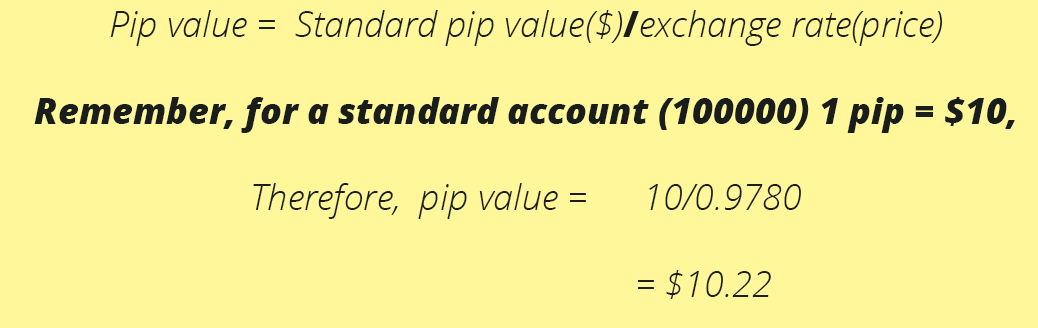

If the USD is not the counter currency but the base currency, we divide the standard pip value by the given exchange rate. Quite confusing, right?

Lets look at the examples below.

You are trading the USD/CHF at 0.9780 using your USD account trading a standard account;

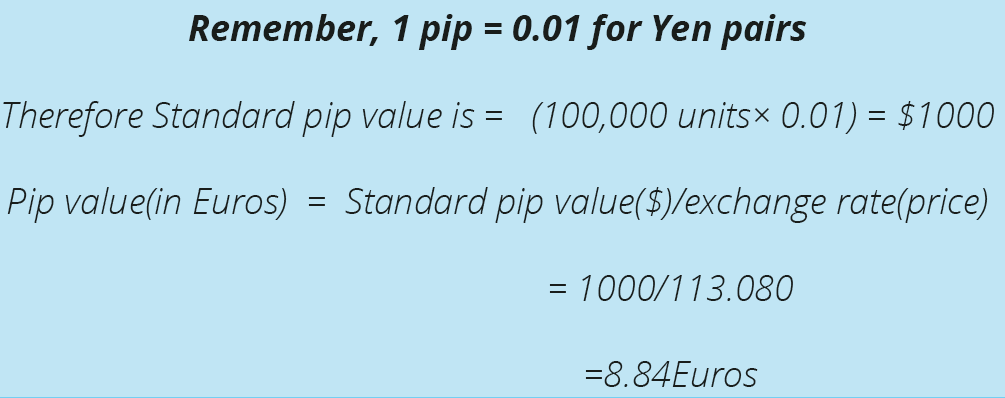

How about when the USD is not traded in the pair.

For example, EUR/JPY at 113.080 (exchange rate) using your USD account standard account

Since your account is in USD, You have to convert the Euros to USD . Guess how to do that! Simple, we now look at the EUR/USD rate.

Assuming the rate is at 1.17855, to get pip value, we simply multiply by the exchange rate

Therefore, pip value (in USD)= (8.84 × 1.17855)

= $10.4

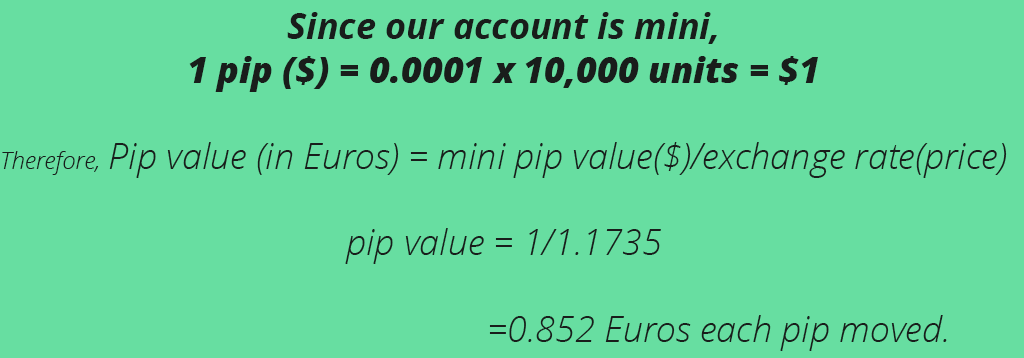

When your account capital is not in USD; in EUR

Let’s assume your account is a mini account in this example

If the quote currency is in USD, and base currency is same as the account denomination ( in this case the EUR).

It means the pair you are trading is EUR/USD. Assuming exchange rate price is at 1.1735

Suppose you buy EUR/USD at the same price 1.1735 and price moved against you and hits your stop loss at 1.1720. You make a loss of 15 pips on this trade.

In order to get the value terms of the base currency; you simply multiply the value per pip and the number of pips moved by the trade.

For this case, we shall have; (0.852 × 15) = €12.78.

Likewise if you make a profit of 100 pips, your profit in the base currency is;

(0.852 × 100 ) = €85.2.

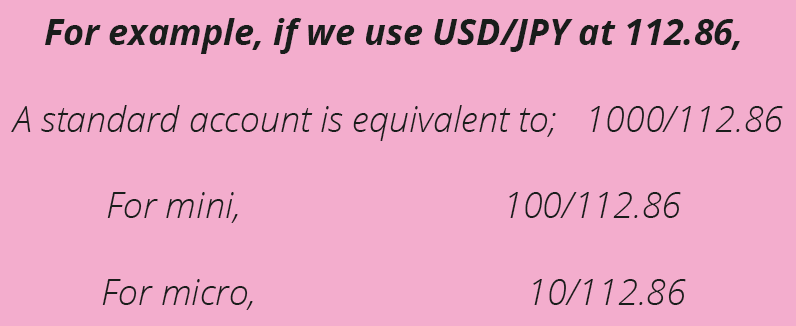

calculate pip value For pairs quoted with the Yen

To calculate pip value for the Yen quote pairs, You should follow the same procedures as above.

Yen pairs/ quotes have 2 or 3 decimal places.

This implies that you will use standard pip values of $1000 for standard account,$100 for a mini account and $10 for a micro.

How to calculate pip value if your account is in your local currency?

Assuming your local currency is not in the currency pair you are trading.

Let’s say your account is in EUR

Example 1

Suppose you are trading USD/CAD standard size at a rate of 1.24511.

Remember, for a standard account (100000) 1 pip = $10,

Pip value =( 10/1.24511)

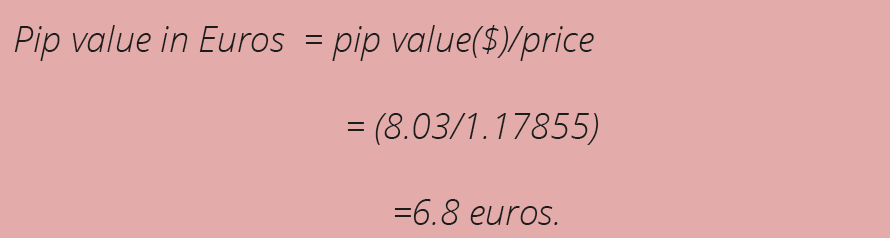

= $8.03

Since your account is in EUR, You have to convert the USD to Euros .

Qn: How do you do that?

Ans: EUR/USD exchange rate

Assuming the EUR/USD exchange rate at 1.17855

Example 2

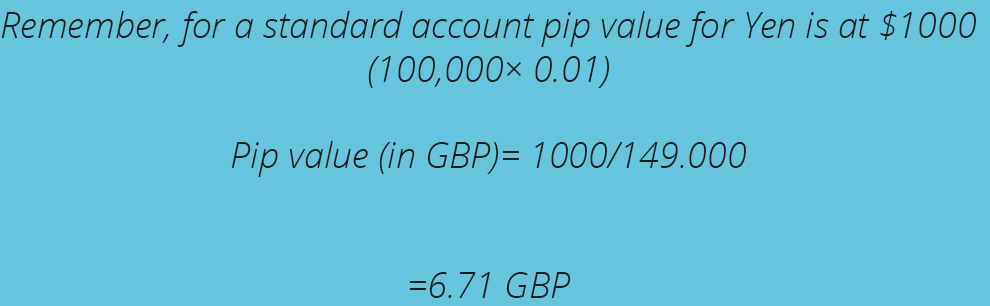

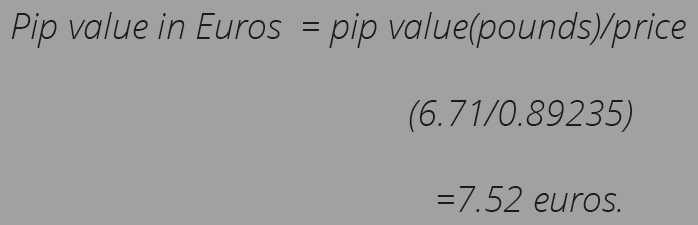

If you are trading GBP/JPY ; a standard account (100000) at 149.000.

Since your account is in EUR, You have to convert the GBP to Euros .

At least now you know how to do that! EUR/GBP exchange rate!

Assuming the EUR/GBP exchange rate at 0.89235

That was such a huge long session of calculations.

Let me remind you that, actually you don’t have to go through all that to determine the pip value for your trades each time you are to enter a trade.

Some one is saying “thanks to God.” Woow!

Technology is here!. So you can use a free pip calculator online to calculate pip value.

Some brokers give a provision of pip calculators on their platform or show pip values on the platform. Which ever currency you are using, you don’t have to worry. Everything is always done for you, you only deposit money and trade.

But if your are a ‘math-holic’ and always wondering how those values are got. You can take the formulas and follow the procedures given above.

You know it good to be curious sometimes. Try it out.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post