JPY moves are mostly significant in the Asian Session. Japan is well-known for its very low or no inflation for almost decade.

This is due to its low interest rates on Yen which has been nearly zero to negative one for a long time.

The low interest rate makes consumption of its exports very cheap hence attracting more foreign consumers for its products.

There are other factors that move the JPY but we shall discuss the major ones.

economic data that moves jpy

Major economic data that moves JPY includes,

1. Gross Domestic Product (GDP)

Gross domestic product data release is a major economic indicator in Japan.

It represents the overall performance of the country’s economy which is a mirror reflector for the strength of the JPY.

This highly moves JPY

A positive GDP reflects growth in the Japan’s economy so more investors never want to miss out at the release of such news.

This means demand for the JPY rises as well as its value.

While a negative GDP report reflects a collapse in Japan’s economic growth which is bad news to investors and may cause a fall in the JPY value.

2. Unemployment rates

Unemployment rate measures the number of people in japan willing and able to work but cannot find jobs .

Higher rate than expected threatens the economy hence weak JPY

It may lead to lack of confidence in consumption and increase in government spending which may result to an economic slow down.

3. Trade balances

Japan is the world’s largest exporter of goods and services .

Its exports are larger than imports. This indicates strong JPY

It has large current accounts surpluses that has positioned it as a net creditor to the world.

This means the value of foreign assets held by Japanese investors is higher than the value of Japanese assets held by foreign investors.

Therefore, investors use the Japanese balances of trade to gauge its economic performance.

4. Consumer price index(CPI)

This measures changes in prices of Japanese goods and services at a general price level for a given period of time .

BOJ uses CPI to track price changes of different goods and services, consumer confidence and track down inflation.

If the value of CPI is so high that it threatens the value of JPY,the BOJ intervenes.

It uses the monetary policy at its disposal to push back inflation rate to its desired target.

The same is done when the value of CPI is very low indication that inflation is not as desired

5. China Economy.

China is the major trading partner of Japan. This heavily moves JPY.

A change in the china’s economy has a great influential in the demand for the Yen.

The high demand of Japan’s goods by Chinese people increases productions and demand for the Japanese currency. This too increases the country’s GDP as well as appreciating the yen.

This is how it works;

As China’s economy expands, demand for imports from Japan also increases.

This in turn increases production in Japan and more demand for Chinese goods to boost production.

The 2 countries depend on one another for their economies to develop .

Increase in demand for Japanese goods increases its export sector and in so doing the Yen adds up value.

On the other hand, a fall in demand for its products lead to the fall in the economy , low exports and this devalues the Yen.

Trading the USD/JPY

The USD/JPY is always seen rallying during the active sessions of the day in the New York Session and European session.

This makes it good time to trade this pair if you are to make good profits from it.

You can also trade USD/JPY during the Asian session when the Tokyo market is active.

Also,

You can consider news release of major fundamental economies from the major trading partners of Japan. Namely; USA, China and Europe.

Getting to know the JPY

The yen is the trader’s favorite currency for carry trade.

It ranks 3rd most traded currency after USD and EUR.

The Japanese economy is the third largest economy in the world.

Japanese Yen is denoted as JPY.

Due to its low and stable interest rate, most investors borrow more of the Yen to invest in high yield securities in other parts of the world.

Most investors buy more of the JPY in times of financial crisis as a safe haven investment.

JPY Trading session

Tokyo being one of the world’s largest financial market centers, Japan acts as a face for Asia as a whole under the money market.

The Yen is commonly demanded when it comes to the Asian trading session when the Tokyo stock exchange is open at the same time.

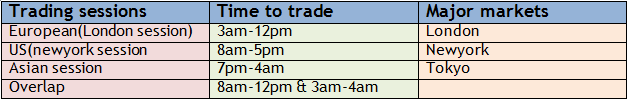

You can also trade it during the European and London session overlap between 8 am to 12 pm,Euro-Asian overlap between 2 am.

The summary of the trading sessions

It is during the Asian session that you can see very significant moves on the Yen due to the economic news releases during this period.

The Yen is also commonly stuck with most crosses therefore economic data release from these countries greatly affect the Yen.

Carry trade and risk haven

Due to JPY stable low interest rate, most traders run to it for carry trade.

This is due to its low interest rates as low as negative to zero rate.

At the same time,

JPY is also a safe haven currency to most traders during the times of economic uncertainties.

When the traders and investors are not confident about the status of the any economy, they will buy more of the JPY for safety.

Japan facts and figures

- Country Name: Japan (Nihon or Nippon), local name(Nihon Koku)

- Government Type: Parliamentary Constitutional monarchy

- Capital: Tokyo

- Independence: 3rd May 1947

- Neighbors: China, North Korea ,South Korea And Russia

- Prime minister: Abe Shinzo

- Currency: Yen(JPY)

- Imports: $629.8 billion

- Exports: 641.4 billion

- Website: http://www.kantei.go.jp/

- Major Cities :Chiba, Fukuoka, Hiroshima, Kobe, Kyoto, Osaka, Sendai, Yokohama.

Monetary and Fiscal policy moves jpy

The Bank of Japan is the Japanese Central Bank that works on currency and monetary policies to achieve the price stability of Japan.

It makes its decisions relying on the majority vote of the 9 members on the policy board.

The board consists of the Governor, the 2 Deputy governors and the 6 other members.

The board discusses the economic and financial situations and decides an appropriate guideline for money market operations

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post