To know if it is a Gold buy or sell, we must understand what the big guys are looking at. The big guys leave their footprints on the price chart. If you critically look at the price action, you can clearly see them. Let us now discuss the price action on the chart so that we can decide if it is Gold buy or sell.

Investing in GOLD, Buy or Sell? Multi-Time Frame Analysis

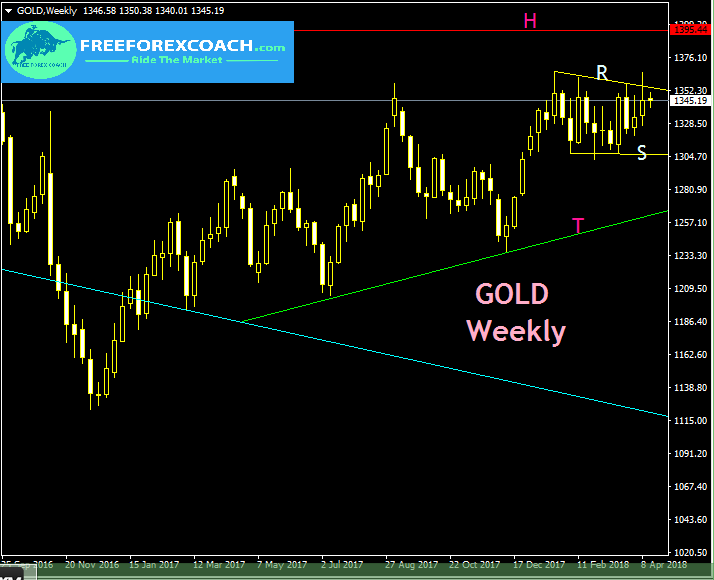

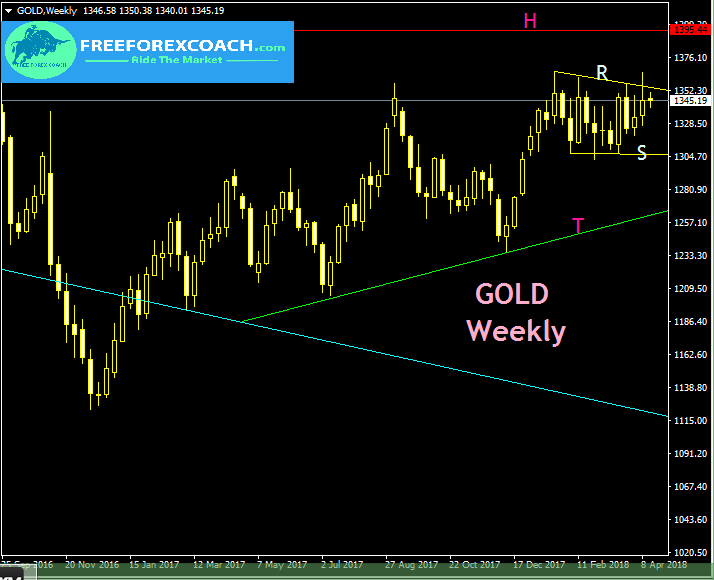

GOLD Weekly chart

The price is into previous highs resistance. Just like we mentioned before, when price comes into levels of support and resistance the mostly likely occurrence is a price congestion. Take a look at the weekly chart below.

Currently we having a price congestion on the weekly chart clearly marked by trendlines R and S. So is it a gold buy or sell now? My answer is; Be a little patient! Wait for candle close confirmations!

Weekly candle close above trendline R could push prices into the next resistance zone around 1392.44 marked with red horizontal line H. Monthly candle close above H could lead prices to higher prices around the 1500.00 psychological price zone.

On the other hand, if weekly candle closes below yellow trendline S, price could fall and retest the weekly green trendline marked T. So it is very important for candle closes beyond the trendlines R or S before you decide if it’s a gold buy or sell on the weekly chart.

Let us now look at the daily chart to clearly see what is happening within this weekly price congestion.

GOLD Daily chart

On the daily chart below, we can clearly now see the congestion. The trendlines R and S are same as those on the weekly chart. Now let us discuss the most important levels so far within the congestion so that we can decide if it is a Gold buy or sell on the daily chart.

From the chart above, the support zone around 1334.53 marked with a red horizontal line B is strong pivotal zone. Daily candle close below the level could lead the price to fall into immediate support marked by purple trendline C.

A candle close below C may lead price to retest the lower level of the congestion on the yellow trendline support marked S.

Looking at the other side, if price daily candle closes above R we may see higher price resistances hitting around 1392.45. But in this case we prefer a weekly candle close above yellow trendline R for confirmation.

NB. Investing in Gold buy or sell on the daily or any lower time-frames must be kept within the congestion marked by yellow trendlines R and S. We will do this until we get a weekly candle close above or below the congestion to confirm a new swing movement.

Now let us look at smaller timeframe to know if we can get a gold buy or sell on the current price action.

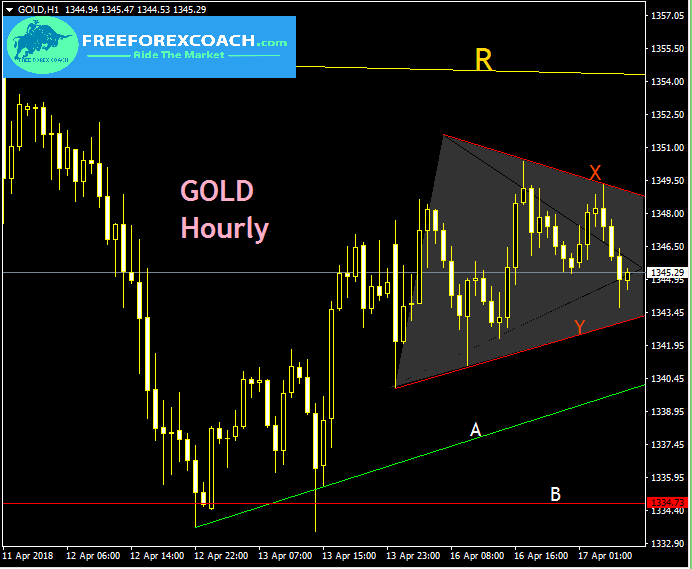

GOLD Hourly chart

The hourly chart shows the candlestick build up within the daily timeframe candles. The yellow trendline R and the red horizontal line B are same as the daily ones on the daily chart above. Let us take a closer look at the hourly chart below for any gold buy or sell signals.

Looking at our chart above a congestion highlighted and marked by red trendlines X and Y. So is it a Gold buy or sell? My answer still same; Be a little patient! Wait for candle close confirmations!

Candle close above red trendline X may lead price to go high and retest the yellow trendline resistance marked R.

Close below red trendline Y could lead price into immediate support marked by green trendline A. Close below A may lead price into previous lows support zone around 1334.73 marked with a red horizontal line B.

Like we earlier mentioned, Investing in gold, buy or sell on the daily or any lower timeframes must be kept within the congestion marked by yellow trendlines R and S at the moment. We will trade within this zone until we get a weekly candle close above or below the congestion to confirm a new swing movement.