Is a Robust Position sizing Model achievable and will it prevent us from being stopped out by whipsaws?

All along, my position sizing model has been based on rigid rules that gave me the illusion of being in control yet I was not.

Position sizing model for Beginners

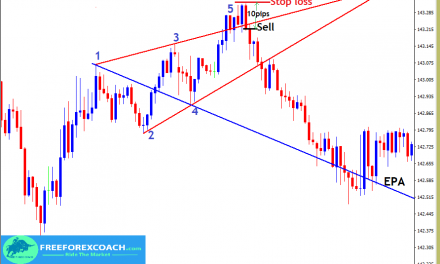

To me a good position sizing model and a possibly robust one for that matter, (it has to be aggressively tested in order to conclusively determine it’s robustness.

At what point is your analysis wrong?

But for now, I would suggest that a system’s expectancy is a good indicator of the model’s robustness ) should fundamentally assess risk from a psychological point of view. And by psychological I mean market psychology (primarily greed and fear) premised on one’s Technical analysis method and market sentiment.

In short, one ought to first ask themselves; at what point will the market prove that my hypothesis is wrong?

But this is often not the case, we amatures size our positions from an emotional point of view. So we assess risk as a form of pain threshold.

We ask ourselves how much pain do I have to endure (moneywise) before my stop loss is hit? And further delude ourselves by thinking., “Well, as long as my loss is within my accepted margin (whether as a percentage or Cash). It’s okay”

I have news for you:

YOU ARE NOT FOCUSSING ON THE TRADING PROCESS fellow Amateur. So your emotions, and in this instance pain, weakens the percentage of objectivity in your technical analysis method (yes technical analysis is not 100% objective.

No form of analysis is thus far).

Pain is an emotion.

Unknowingly, you have just mixed your trading with an emotion but deceiving your mind that you are in full control of your bottom line! hence setting yourself to fail in the long-run.

Emotions Vs Trading Success

I can confidently assume that it is impossible to become a successful trader if one has not managed to control his or her emotions. (Only i can assume because i don’t know every successful trader out there maybe there are some who are uncontrollably emotional in their trading and are successful ).