In this lesson, we will discuss the most important 3 types of price breakouts in the forex market.Previously, we discussed what breakouts are and how to measure volatility on breakouts.

3 types of breakouts in forex include

- Continuation Breakouts

- Reversal Breakouts

- False Breakouts

Let’s dig in.

1. Continuation breakouts

The continuation breakouts occur after the completion of prices consolidation in a trend.

When price continues in its initial trend direction after a small pause.

The indecision between the buyers and the sellers is what causes congestion and consolidations in the Forex market.

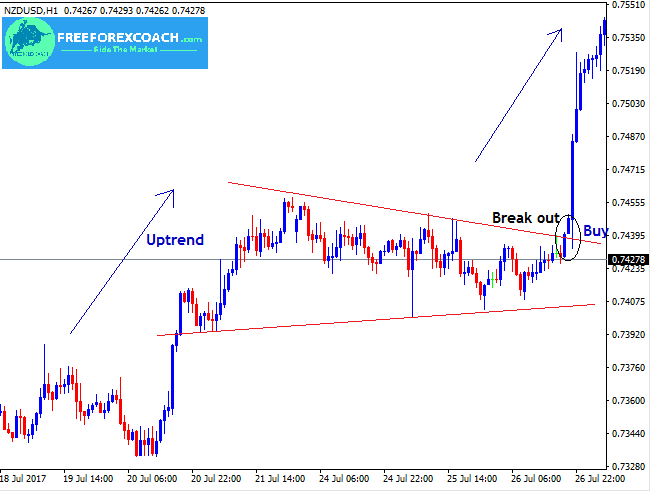

Let;s look at an example below on the NZDUSD, Hourly chart

From our chart above, initially price was in an uptrend.

It then paused forming a wedge then the ultimate break out.

After the breakout, price continued trending upwards.

In this case, you would buy after the breakout confirmation. ie when the candle closes above the upper trend line.

2. Reversal breakouts in forex

The reversal breakout appears after the exhaustion of the trend/trend climax .

This is when the currency has moved in one direction for a long time and has been overbought or oversold.

A reversal break out leads to change in the direction of the trend after the break out.

Take a look at the NZDCHF, 4-Hour chart below;

Looking at the chart above,

Price was in an extended downtrend, then we had a channel congestion. Then price broke through the resistance level, leading to a trend reversal.

The buy signal confirmation is a the candle close above resistance level.

3. False breakout

This happens when price breaks out the defined levels of support and resistance for a short time and does not continue but moves back to the opposite direction.

These are some of the traders’ nightmares.

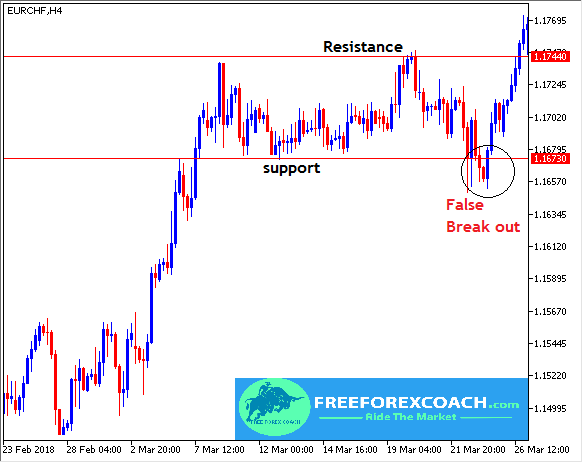

Take a look at the EURCHF, 4-Hour chart below;

From the chart above,

We had a breakout below support and then price reversed back hitting any set stops.

This is so frustrating especially for traders who don’t use any risk management plan.

False break outs can be avoided by letting price to first retest back the broken levels to get a clear confirmation for your entry.

Yes, sometimes you may miss some trades but it protects you from many false break outs.

We will dig deeper in the next lessons on how to trade False break outs

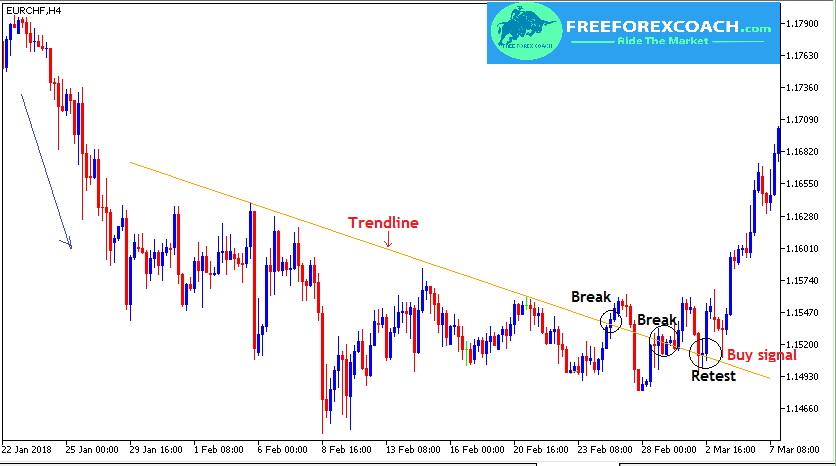

Let’s look at an another example below on the EURCHF, 4-Hour chart.

From our chart above,

We had breakouts of the price above the trend line.

So what you do, is to wait for a retest as shown above.

This is your confirmation for the entry signal, in this case, it was a a buy.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post