The 2% risk rule on each trade in forex is one of the most vital rules in Forex risk management.

It simply means, not to risk more than 2% of your account on any trade you take.

Risking only 2% of your capital keeps you long in the game and keeps your losses as low as possible.

Why you should stick to the 2% risk rule in forex?

It keeps your risk level for your account at a small amount to avoid unpredictable changes in the market from wiping away your account.

This gives you more chances to grow your account since your capital is preserved.

It’s very important to determine how much you are willing to risk before entering any trade.

The 2% rule helps you to determine how much you can risk per trade.

Also it helps you to stay in a game long enough even after having 5 consecutive losing trades.

However much your system may not perform in the first 5 consecutive trades as expected, the 2% rule will save you enough capital to stay in a game.

You are always given a second chance to trade, evaluate and improve your system to a better standard.

Managing your risks is a key element to being a successful trader.

Losses are always going to occur but limiting the losses and preserving your trading capital are vital for staying in a game.

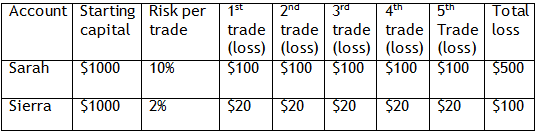

Example on trading with a 2% rule risk

Considering my two friends Sarah and Sierra who had a big dream in Forex trading.

However,despite their friendship trust, the two couldn’t agree on who should manage their account.

Sarah is an aggressive trader and Sierra is a conservative trader. Completely different traders.

So they decide to divide the money into two accounts so that each of them trades her own account but agreed to use the same system to trade.

Each holding an account of $1000, Sarah risks 10% per trade and Sierra decided to take up a 2% rule risk per trade.

After a month’s analysis, the system records 5 consecutive losses from both accounts.

Their Account Results;

Sarah’s risk per trade; (10%×1000)=$100

Sierra risk per trade; (2%×1000) = $20

Their journal is as follows;

After 5 trades, Sarah had already made a draw down of 50% while Sierra had 10% loss off her account.

Sierra’s loss was still insignificant and she still had enough capital to go for more trades.

However, Sarah was on tension scared that just more 5 losses can wipe out the account.

It would take Sarah more 5 trades to get out of the game and Sierra still had 90% chances in the game.

As you plan to trade, risk only what can keep you in the game no matter big the draw down is.

It is advisable to always consider 2% or less for each trade you take till your account grows big enough. Then you can put to 3-5%, only if you feel comfortable with it.

How do you get back to break-even

The bigger the percentage loss the harder it will take you to break-even.

For instance, from the example above, it would take Sarah to win more 10 trades to break even and Sierra would need only 6 trades to break-even.

Risk per trade: Sierra, (2%×900)=$18 per trade and ( 10%×500)= $50 for Sarah.

To get the account back to $1000, Sarah needs 10 winnings trade; =(10×50)+$500= $1000

And sierra needs 6 winning trades to break-even; (6×$18) + $900=$1008.

When you make a bigger loss, it becomes harder to get back to your original account balance.

Therefore, the 2% risk rule is not for only the conservatives but for those who want to consistently profit from trading.

If you are so quick to yearn for bigger profits, your account will be wiped out so quickly and you be out of the game without knowing.

Unfortunately a lot of people still lose money in trading, it is just because they ignore such simple rules like the 2% rule.

Determining how much you want to risk per trade gives you a clear picture on making decisions for your trades and saves your account from heavy blows.

If you can stick to risk management rules. You can consistently grow your money profitably.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post