Fibonacci trading summary is an overlook of all we covered in detail in previous lessons.

The Fibonacci comprises of Fibonacci Retracement, Fibonacci Time frame, Fibonacci Fan, Fibonacci Arcs, Fibonacci channels and last but not least Fibonacci extension.

Fibonacci Trading summary – retracements

Traders use Fibonacci retracements to determine potential entry levels for trades.

Fibonacci retracements are represented with lines marked with numbers either in percentages or decimals. These can be drawn as follows;

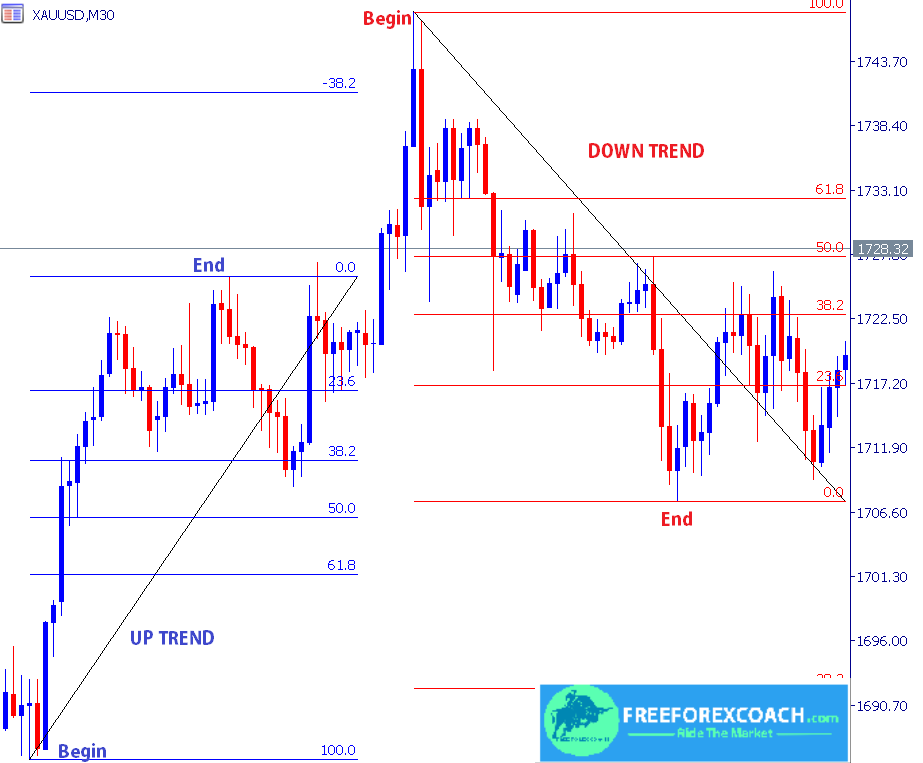

In an uptrend, pick up a previous lower low place your cursor and drag it up to the higher high of the swing.

In a downtrend, pick a higher high of the previous swing hold and drag the cursor down to its lower low and release.

The major Fibonacci retracement levels are 23.3%, 38.2%, 50.0%, 61.8% and 100.0%.

Retracement levels are not only used to determine entry levels but also stop loss targets and take profit targets.

After your entry, put your stop loss below or above the entry next to the previous level and the profit targets on the next levels.

The commonly used levels for profit targets are 61.8% and 50.0%.

In addition, retracement levels also work the same way as support and resistance levels. Price tends to hold, reverse or break through. You can always treat them as support and resistance.

Apart from Fibonacci retracement levels, you can also use Fibonacci extensions or expansions to determine exit/take profit levels.

Extensions/expansions – summary

You can use Expansions the same way you use Fibonacci retracement. The Fibonacci expansions show how far the next price wave could move after a pullback/retracement.

In order to use the expansion/extension tool;

Reach for the upper left corner of your chart.

Click on insert option, it will drop a list of tools. Move your cursor to Fibonacci, then select expansion.

Now move the cursor to the chart to the point where you want to plot. With it, it carries a small icon like a Fibonacci shape. click on the point you chose then drag to extend to the next point.

Now that you know how to use the two tools, let’s look at the most important things to consider when trading Fibonacci.

Fibonacci Trading Tips Package

Last tips on the fibonacci trading summary

First,

Fibonacci retracement levels work best when the market is trending. Therefore, when trading with Fibonacci retracements, you should always aim at trading in the direction of the main trend.

Secondary,

Fibonacci works better when combined with other tools. For example, support and resistance, trend lines and candlesticks.

Combining with other Tools – Fibonacci Trading Summary

When trading Fibonacci with candlesticks, consider the reversal candlestick patterns such as bullish and bearish engulfing patterns, to mention but a few.

On the other hand, if you choose to trade Fibonacci with support and resistance, consider areas where the support or resistance coincides with the Fibonacci levels. I would call this a double trouble.

But in case you choose to trade Fibonacci with trendline. it is also a strong strategy. Take a trade entry at a point where a trendline intersects with the Fibonacci retracement level.

All the above make strong strategies to trade and are more profitable, holding other factors constant. For instance, risk management.

It is also important to note that; not all the time these level will hold or price will always bounce off these levels. It can break the level or fails to reach it. When this happens, the set up becomes invalid.

Last but not least, you can also use Fibonacci extensions/expansions to determine your take profit.

Remember, The Fibonacci expansions show how far the next price wave could move after a pullback/retracement.

All in all, like any other technical indicator, nothing works 100% correct in the market.

Due to the market dynamic economic changes anything can happen even if all seems perfect at that moment.

Above all. the most important thing is to trade with your risk management kit. Always trade with a stop loss and use realistic sizes depending on the size of your trading account.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post